Why Approved Generic Drugs Still Aren’t on Shelves

Imagine your doctor prescribes a generic version of a popular medication-say, Eliquis or Xarelto-and you walk into the pharmacy expecting to pay a fraction of the brand-name price. But when you ask for it, the pharmacist says, "It’s been approved by the FDA since last November. We just can’t get it." This isn’t a glitch. It’s the new normal in U.S. pharmaceuticals.

From 2023 to 2025, the FDA approved 63 first generics that still hadn’t reached patients by the end of 2025. Why? Because even after the FDA says a drug is safe and effective, patent lawsuits can lock it out of the market for years. The system meant to speed up affordable medicine is now being used to delay it.

The 30-Month Stay: A Legal Lockout

The heart of the problem lies in the Hatch-Waxman Act, a 1984 law designed to balance innovation and access. It lets generic manufacturers challenge brand-name patents by filing what’s called a Paragraph IV certification. This triggers a 30-month automatic stay that blocks the FDA from giving final approval.

That sounds fair-until you realize that in 68% of generic applications in 2024, the generic company challenged at least one patent. And the average drug now has 14.7 patents listed in the FDA’s Orange Book, up from 12.3 in 2020. Brand companies don’t just defend one patent. They file dozens, sometimes on minor changes like coating thickness or tablet shape. Each one resets the clock.

It’s not about whether the patent is valid. It’s about time. The 30-month stay isn’t a court decision-it’s a legal pause button. And brand-name companies press it again and again.

Patent Thicketing: The Real Game

Dr. Aaron Kesselheim of Harvard Medical School put it plainly: "Originator companies have extended monopolies beyond the 20-year patent term by an average of 3.7 years per drug." That’s not a fluke. It’s strategy.

Take Humira. Its core patent expired in 2016. But AbbVie filed over 240 patents related to it, creating what experts call a "patent thicket." By the time the first biosimilar finally launched in 2023, the company had protected its market for 10 years past the original patent expiry.

This isn’t rare. In 2025, the average number of patents challenged per biosimilar application jumped to 9.7, up from 5.2 in 2020. The goal isn’t to win every lawsuit. It’s to drag out the process until the generic company runs out of money-or the brand’s patent portfolio is so thick that no one dares to challenge it.

Who Gets Hurt? Patients and Pharmacies

The cost isn’t just financial. It’s human.

A 2025 survey by Patients For Affordable Drugs Now found 412 documented cases between January 2023 and September 2025 where patients skipped doses or stopped taking their meds because the generic wasn’t available. The brand-name versions cost an average of $487 per month. The generics? They should’ve been around $85.

Pharmacists are on the front lines. One pharmacist on Drugs.com wrote: "We had the generic for Xarelto approved last November but still can’t get it-the brand company filed three new patents last month. Now we’re looking at another 30-month delay."

According to the American Society of Health-System Pharmacists, 78% of hospital pharmacy directors say patent delays are a "major contributor" to drug shortages-especially for cancer drugs. In oncology, the average delay between FDA approval and market launch is 4.1 years. That’s longer than most PhD programs.

Why the FDA Can’t Fix This

The FDA approves drugs. But it doesn’t decide patent disputes. That’s the courts. And the agency has no power to override a 30-month stay-even if it knows the patent is weak.

Dr. Patrizia Cavazzoni, FDA’s CDER Director, admitted in May 2025: "Patent litigation remains outside our regulatory authority." She’s right. But she also said the agency is trying to make patent listings in the Orange Book more accurate to stop "evergreening." That’s a start-but it’s like trying to stop a flood with a sponge.

The FDA’s new AI review system cut approval times by 22% for drugs without patent fights. But for those with litigation? No change. The 30-month stay still rules.

Supply Chains and Complex Drugs Make It Worse

It’s not just patents. Complex generics-like injectables, inhalers, and biologics-are harder to make. And their supply chains are fragile.

Between 2023 and 2025, 37% of delayed generic launches cited problems getting the active pharmaceutical ingredient (API). Most of these were injectables. One oncology drug shortage was tied to a single supplier in India shutting down for regulatory reasons.

Companies like Teva and Sandoz have responded by increasing their approved API suppliers from 1.8 on average in 2022 to 3.4 in 2025. That’s smart. But it’s expensive. And it doesn’t help if the patent lawsuits keep the drug off the market anyway.

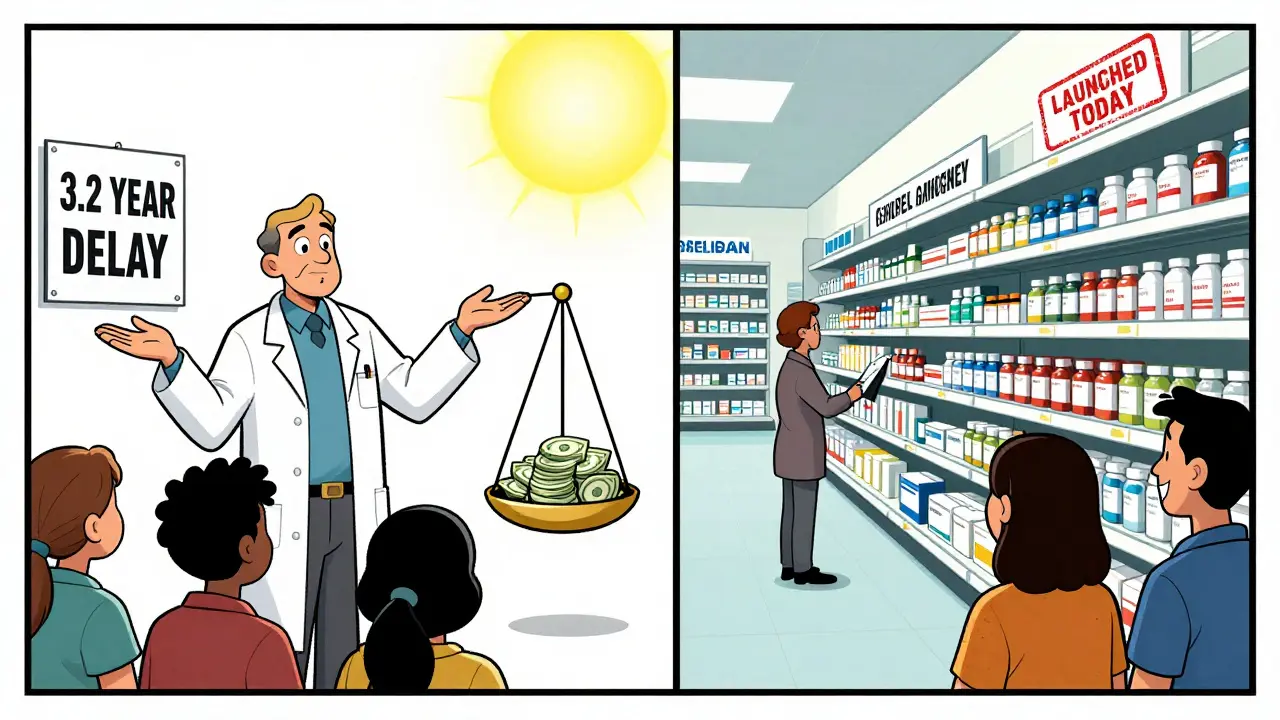

U.S. vs. Europe: The Gap Is Growing

While the U.S. drags its feet, Europe moves faster. In the EU, the average time between generic approval and market launch is 1.7 years. In the U.S., it’s 3.2 years.

Why? Europe doesn’t have the same patent linkage system. If a generic is approved, it can launch unless a court rules the patent is valid. No automatic 30-month hold. No endless patent stacking.

And it shows in prices. A 2024 IQVIA report found that generic prices in Europe drop 50% faster after market entry than in the U.S.

What’s Being Done? Not Enough

There’s been talk. The FTC filed 7 enforcement actions between 2024 and 2025 against companies using "pay-for-delay" deals or patent thicketing. One case against Jazz Pharmaceuticals over Xyrem ended in a settlement requiring earlier generic entry.

The CREATES Act, meant to help generic companies get samples for testing, stalled in Congress in 2025. The FDA’s new priority voucher program speeds up reviews-but only for non-patent cases.

And the real blocker? Money. The average cost of patent litigation for a generic company hit $12.7 million per case in 2025. That’s more than most small generic firms make in a year. So they don’t fight. They wait.

What’s Next? The Future Is Unclear

The top 10 drugs losing exclusivity in 2025 had $78.3 billion in annual sales. That’s a lot of profit to protect. And the brand companies are spending billions to do it.

McKinsey found that 67% of industry stakeholders support limiting the number of patents per drug. But PhRMA, the drug industry lobby, says that would "undermine innovation." They’re right that innovation matters. But not when innovation means filing 15 patents on a pill to keep prices high.

With Dr. Peter Bach as FDA Commissioner since January 2025, there’s hope for more transparency. But real change will need Congress to fix the Hatch-Waxman Act-not just tweak the rules.

Final Thought: Approval Isn’t Access

Having a drug approved by the FDA doesn’t mean it’s available. The system was built to balance innovation and access. Today, it’s tilted hard toward the former.

Patients are paying more. Pharmacies are frustrated. Hospitals are rationing. And the companies that make affordable drugs? They’re being priced out of the game.

Until patent lawsuits stop being a tool to delay competition-not defend it-the promise of generic medicine will keep being broken.

Harriot Rockey

This is insane 😭 I had to skip my mom’s blood pressure med last month because the generic wasn’t available. We paid $500 for a 30-day supply when it should’ve been $80. Why does this keep happening? 🤦♀️

Alec Stewart Stewart

I work at a small pharmacy and this is our daily reality. We get the approval notice, then the brand company files another patent. We just sigh and tell patients to come back next month. Again.

Geri Rogers

Let me be real - this isn't broken, it's BY DESIGN. Big Pharma doesn't want generics. They want you dependent on $500 pills so they can keep raking in billions. The FDA? They're just the paper pushers. The real villains are the lawyers and lobbyists who write these laws. #StopTheThickets

Samuel Bradway

I didn't even know this was a thing until my cousin got denied her chemo generic. Now I'm reading everything I can. This is messed up.

Caleb Sutton

This is all a cover for the New World Order. The government and Big Pharma are working together to keep you sick so they can sell you more drugs. The 30-month stay? It’s a mind control tactic. They don’t want you healthy. They want you compliant.

pradnya paramita

The Hatch-Waxman Act’s Paragraph IV framework creates a structural inefficiency where patent challenges trigger automatic stays, effectively enabling reverse payment settlements and patent thicketing. The regulatory arbitrage is systemic, and the Orange Book’s lack of dynamic auditability exacerbates the issue.

Jamillah Rodriguez

I just scrolled through this whole thing and now I'm mad. Like, why is this even a thing?? Can we just fix it?? 😩

Janice Williams

It is deeply regrettable that the American healthcare system has devolved into a corporate oligopoly wherein the sanctity of intellectual property is weaponized to the detriment of public health. One cannot help but observe the moral bankruptcy of a society that permits such exploitation.

Ed Mackey

wait so if the fda approves it why cant they just sell it?? i mean like... i thought the fda was the one who said it was safe? so why are courts getting in the way? this makes no sense. i think someone is lying.

Joseph Cooksey

You know what’s really sad? It’s not even about the money anymore - it’s about control. These companies don’t just want to delay generics, they want to make you feel guilty for wanting affordable medicine. They paint you as ungrateful if you question why a pill that costs $2 to make is priced like a luxury watch. And then they wonder why people are angry. Newsflash: people aren’t angry because they’re lazy. They’re angry because they’re dying because they can’t afford to live.

Keith Harris

Oh please. You think this is bad? Wait till you see what happens when they start patenting *algorithms* that predict when you'll run out of meds. Next thing you know, your Fitbit will bill you $100 for reminding you to take your pill. This isn't capitalism - it's a dystopian horror show.

Mandy Vodak-Marotta

I used to work at a hospital pharmacy. We had this one oncology drug - generic approved in March 2024. Still not in stock in June 2025. We had to tell patients, "We have the medicine, we just can’t give it to you." One woman cried. Said she’d been saving for months. I still think about her. This isn’t policy. This is cruelty dressed up as law.

Nathan King

The institutional framework governing pharmaceutical patent litigation in the United States represents a profound misalignment between statutory intent and emergent market behavior. The Hatch-Waxman Act, while laudable in its original conception, has been rendered functionally obsolete by the strategic aggregation of non-substantive patent claims.

Antwonette Robinson

Wow. So the FDA approves it. But the courts? They say no. So what’s the point of the FDA? Just a fancy stamp for marketing? 😒

caroline hernandez

The key to resolving this is tiered patent review: prioritize validity assessments for high-cost, high-demand therapeutics before granting 30-month stays. Also, incentivize API diversification via tax credits - not just for generics, but for upstream suppliers. We need supply chain resilience paired with legal reform.