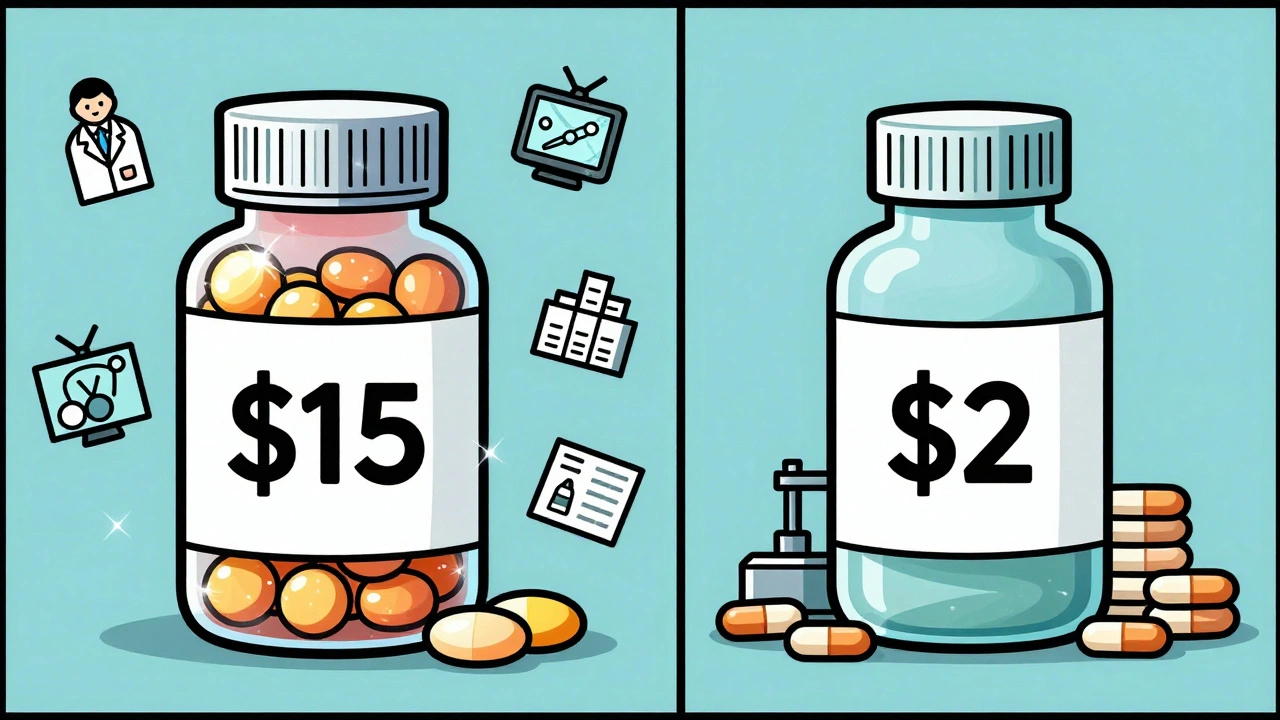

Why does a bottle of generic ibuprofen cost $2 while the brand-name version costs $15? It’s not magic. It’s math. And the numbers behind generic drug manufacturing tell a clear story: generic production is cheaper because it skips the most expensive parts of drug development and focuses on efficiency at scale.

What You’re Not Paying For

When you buy a branded drug, you’re not just paying for the pills. You’re paying for 10 to 15 years of research, dozens of clinical trials, and millions spent on marketing. The average cost to bring a new branded drug to market? Around $2.6 billion. That’s not a typo. That’s what companies like Pfizer or Merck spend before they even put a single tablet on the shelf. Generic manufacturers don’t do any of that. They don’t need to. Thanks to the 1984 Hatch-Waxman Act in the U.S., all they have to prove is that their version works the same as the original. That’s called bioequivalence. No need to test it on thousands of patients again. No need to run 12-year clinical trials. Just show that the active ingredient dissolves the same way, hits the same blood levels, and has the same effect. That cuts development costs from $2.6 billion down to $2-5 million. That’s a 99% drop. And that’s where the price difference starts.The Real Cost Breakdown: What Goes Into a Generic Pill

Let’s look at what actually makes up the cost of a generic drug. It’s not complicated:- Active Pharmaceutical Ingredient (API) - This is the actual medicine. It’s the biggest single cost, making up 40-60% of production. Prices for APIs can swing 20-30% in a year based on where the raw materials come from - China, India, or Europe.

- Excipients - These are the fillers, binders, and coatings. Things like lactose or cellulose. Cheap. Easy to source. Often bought in bulk.

- Quality control - Every batch has to be tested. This isn’t optional. The FDA requires it. But it’s standardized. No need to invent new tests.

- Packaging - Blister packs, bottles, labels. Simple. Automated. High volume.

Scale Is Everything

The bigger the production run, the cheaper each pill gets. It’s simple economics. When you make 10 million pills, you can buy API in bulk. You run machines 24/7. You spread fixed costs like factory rent and regulatory paperwork across millions of units. Here’s the kicker: for every time you double your production volume, your cost per unit drops by 18%. If you double the number of pills made for a single drug - say, from 10 million to 20 million - your cost per pill falls even more, by up to 45%. That’s why the same generic drug can cost 54% less with just two competitors on the market. With six or more, prices can drop over 95% from the original brand. That’s not speculation. It’s FDA data from 1,200 drug products.

Why Brand Drugs Still Charge More - Even When Generics Are Available

You’d think once a patent expires, the brand-name drug would disappear. But it doesn’t. Many companies that make branded drugs also make the generic version. They just sell it under a different label. Here’s the strange part: the same company might sell the branded version to a pharmacy for $10 and the generic version for $1. But the pharmacy still charges you $10 for the branded version and $1 for the generic. The pharmacy’s profit on the branded version? Up to 1,000% higher than on the generic. Why? Because the brand still carries the name. People trust it. Insurance companies sometimes still prefer it. And the manufacturer makes more money off the brand, even if they’re the same pill. That’s why generics capture 90% of U.S. prescriptions - 8.9 billion in 2023 - but only 15.8% of total drug spending. People are taking generics. But the system still pays more for the brand.Where Generics Struggle - And Why

Not all drugs are easy to copy. Simple pills? Easy. Inhalers? Injectables? Complex. These require advanced manufacturing. Tiny differences in particle size, spray pattern, or sterile environment can make a big difference in how the drug works. That’s why there are fewer generic competitors for these products. The barrier to entry is high. You need specialized equipment. Trained staff. Strict regulatory oversight. So prices stay higher. And shortages happen more often. In 2022, there were 350 active drug shortages in the U.S. Many were for generic injectables. Why? Because no one wants to invest millions in a low-margin product if one factory shutdown can wipe out supply.

Queenie Chan

Okay but have you ever tried to get a generic version of something like Adderall? The first time I did, I swear it felt like someone swapped my brain for a potato. Not all generics are created equal, and yeah, I know the science says they’re bioequivalent-but biology isn’t math. My body doesn’t care about FDA benchmarks. It cares if I can focus without wanting to scream into a pillow.

Also, why do the ones from India always taste like burnt plastic? I’m not even mad, just curious.

Stephanie Maillet

It’s fascinating-really, profoundly so-that we’ve built an entire economic ecosystem around the illusion of difference… where two pills, chemically identical, are treated as if one is a sacred relic and the other is trash…

And yet, we don’t question it. We don’t interrogate why the same molecule, in the same dosage, with the same dissolution profile, commands such wildly different social capital…

Is it branding? Or is it fear? Fear that if we admit the truth-that the pill doesn’t care about the logo-we might have to admit that so much of modern medicine is performance…

And that’s terrifying, isn’t it?

Michaux Hyatt

Great breakdown! One thing people forget: the reason generics are so cheap isn’t just because they skip R&D-it’s because they’re made in places where labor and regulations are cheaper, and then shipped here. That’s why supply chain issues hit so hard.

Also, big pharma sometimes buys up generic makers just to keep prices from dropping too far. It’s not always free market-it’s more like ‘free market, but with a velvet glove.’

And yeah, the 90% prescription stat is wild. We’re all using generics. We just don’t want to admit it when the brand name is on the bottle.

Frank Nouwens

While the economic rationale underpinning the cost differential between branded and generic pharmaceuticals is both empirically sound and statistically robust, it is worth noting that the psychological valence assigned to brand-name medications persists in clinical practice, despite the absence of pharmacological distinction.

Furthermore, the regulatory framework established under the Hatch-Waxman Act constitutes a pragmatic compromise between innovation incentives and public accessibility-though its efficacy is increasingly strained by global supply chain vulnerabilities and manufacturing consolidation.

One might posit that the continued premium pricing of branded agents reflects not merely consumer preference, but institutional inertia within insurance and pharmacy benefit management structures.

Aileen Ferris

generic drugs r teh best but like… why do they always make me feel weird? i think they’re putting cheap stuff in them. like, i swear my ibuprofen tastes different every time. maybe they’re swapping the pills for chinese filler or something. also, who even owns the factories???

Nikki Smellie

90% of prescriptions are generics… but have you ever wondered who’s really controlling the API supply? 🤔

China makes 80% of the active ingredients. And we know how they treat workers. And the FDA inspections? They’re just a show. The plants that get shut down? They reopen under a new name. Same owners. Same toxins.

And don’t get me started on the FDA’s cozy relationship with big pharma. You think they really want generics to win? They get kickbacks from brand-name companies. That’s why approval times are still slow. It’s not about safety-it’s about profit.

They’re poisoning us slowly… and calling it ‘healthcare.’ 💉☠️

David Palmer

so like… i just take whatever’s cheapest. if it’s a pill that says ibuprofen on it, i don’t care if it’s made in a cave by monks or a robot in Mumbai. i just want it to stop my headache.

why are we even having this conversation? it’s not like the brand name one tastes better or anything. also, i once took a generic and it made me burp. so maybe they’re just bad. who knows.

Regan Mears

Let me just say-this is one of the clearest, most compassionate explanations of generic drug economics I’ve ever read.

People think generics are ‘inferior’ because they’re cheap-but that’s like saying a bicycle is inferior because it doesn’t have a turbo engine. It still gets you where you need to go. And it doesn’t cost $10,000.

What’s heartbreaking is that so many patients are still afraid to switch, even when their doctor says it’s fine. We need more education, not more fear.

And yes-$360 billion saved? That’s not a number. That’s lives. That’s people who didn’t skip doses because they couldn’t afford it.

Thank you for this.

Ben Greening

The data presented is compelling and aligns with established economic models of market competition in pharmaceuticals. The marginal cost reduction observed with increased production volume conforms to standard economies of scale theory. However, the assertion that generic drugs are ‘just the medicine’ neglects the role of formulation variability, which, while statistically insignificant in aggregate, may manifest clinically in pharmacodynamically sensitive populations.

Further research into bioequivalence thresholds and patient-reported outcomes is warranted.

Neelam Kumari

Oh wow. A whole essay on how cheap pills are made. Did you forget to mention that the same companies that sell you the $15 brand also sell the $2 generic? And they make more profit off the $15 one? Classic. You’re just a shill for the system.

Also, India makes 40% of U.S. generics? And you think that’s safe? They can’t even clean their own streets. Your ‘bioequivalence’ is a fairy tale for people who don’t read the news.

Next you’ll tell me the water’s fine.

Doris Lee

It’s beautiful, really. People think cheap means bad-but here’s proof that sometimes, the most honest thing in medicine is the simplest. No hype. No ads. Just the medicine you need.

And the fact that it saved $360 billion? That’s not just a number-it’s a family keeping the lights on. A kid getting their asthma meds. A grandparent not choosing between food and pills.

Keep pushing for more generics. We’re doing better than we think.

Kaitlynn nail

Generics are for peasants. Real people take the brand. It’s not about the pill-it’s about the ritual. The label. The trust. The *aesthetic* of healing.

Also, my therapist says I need to stop equating value with price. But I still want the blue one.

Michaux Hyatt

Just saw Nikki’s comment and had to respond-no, the FDA isn’t in bed with big pharma to suppress generics. They shut down 18 plants last year for bad practices. That’s not a cover-up-that’s enforcement.

And yes, China supplies a lot of APIs, but so do India, Germany, and even the U.S. The supply chain isn’t perfect, but it’s monitored. The real problem? Profit-hoarding by pharmacy benefit managers, not the generic makers.

Let’s fix the middlemen, not the pills.